35+ Mortgage calculator how much borrow

Over 170000 positive reviews with an A rating with BBB. Typically lenders cap the mortgage at 28 percent of your monthly income.

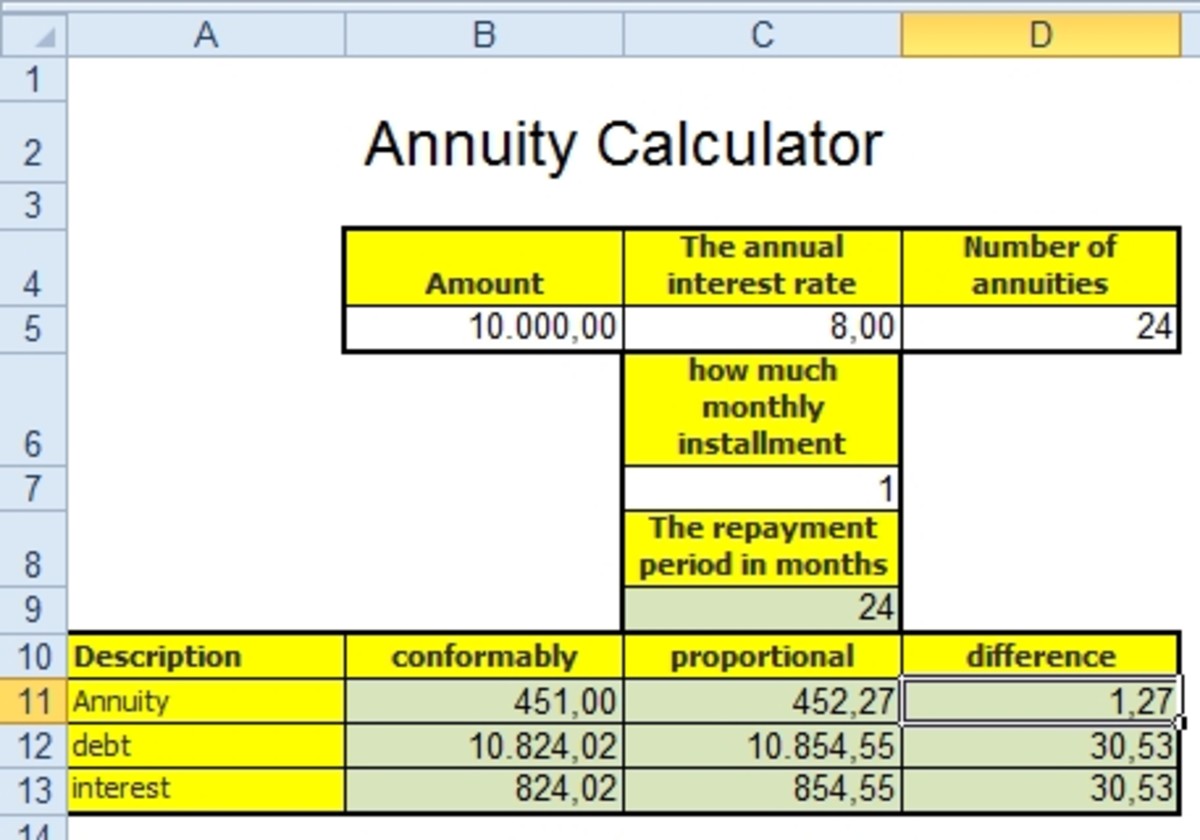

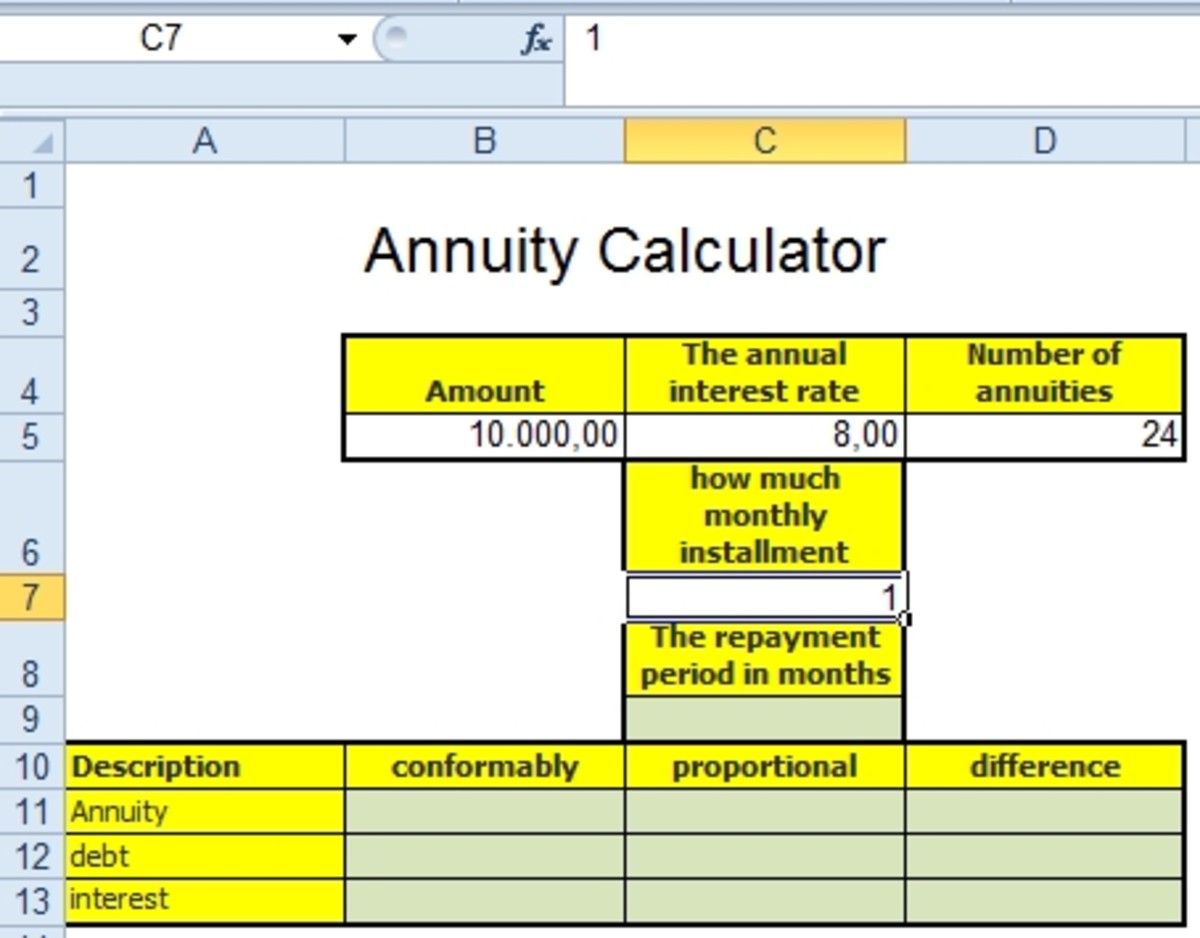

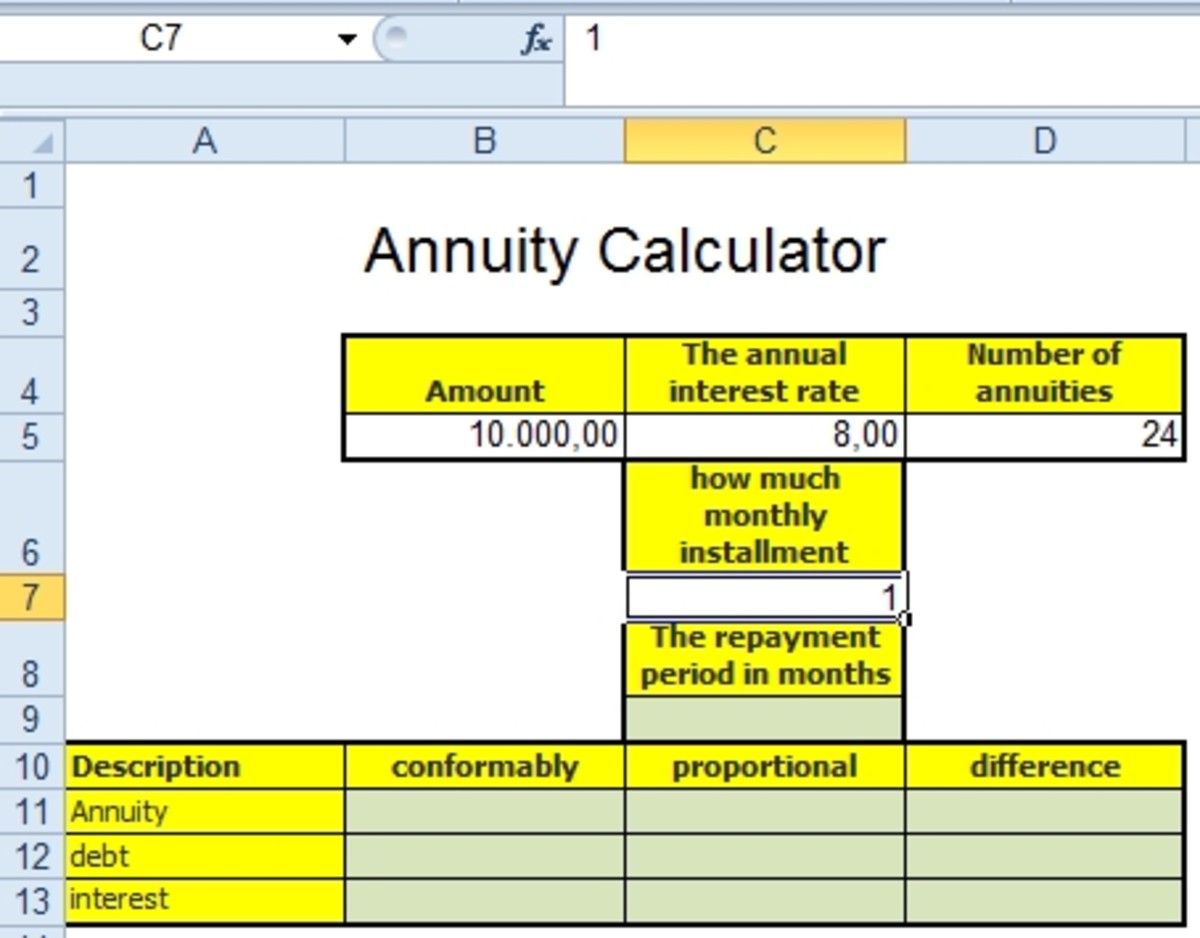

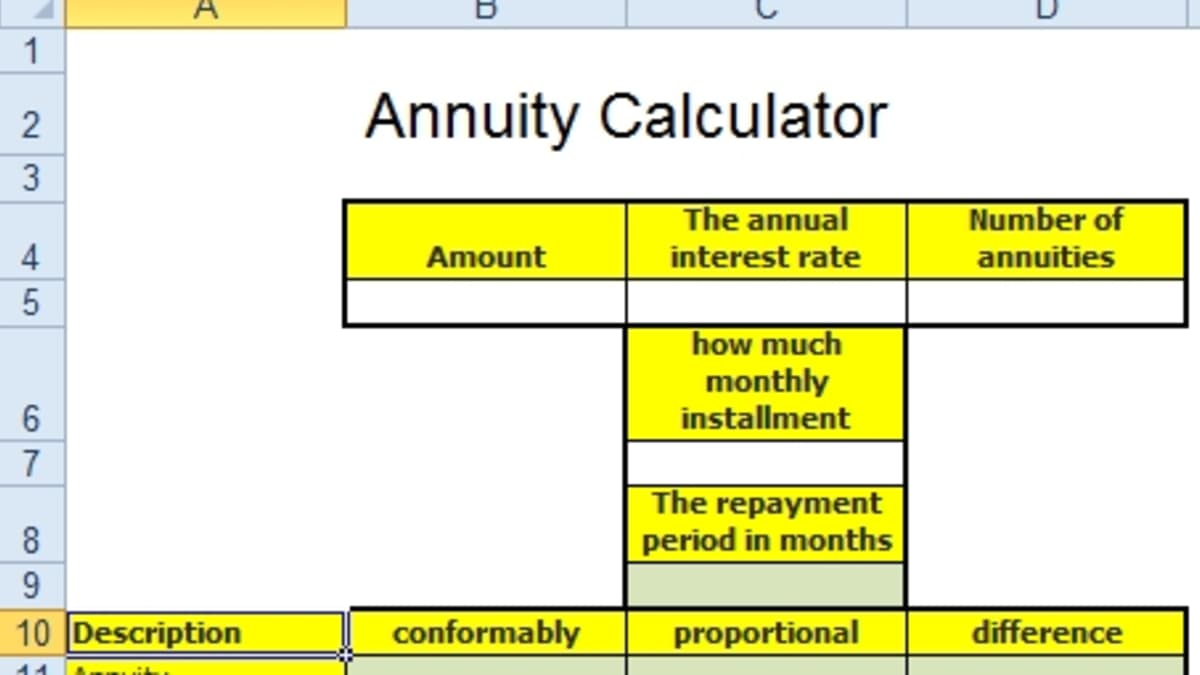

How To Calculate Repayment Of A Loan In Excel Hubpages

A mortgage is one of the biggest commitments youll make in your financial life.

. Payment history 35. An MMM-Recommended Bonus as of August 2021. Want to know exactly how much you can safely borrow from your mortgage lender.

You can calculate your mortgage qualification based on income purchase price or total monthly payment. Todays national mortgage rate trends. Please get in touch over the phone or visit us in branch.

1681276 for surprisingly efficient and user-friendly and free comparison of refinancing rates on both home and. Our mortgage qualifying calculator will give you a precise maximum mortgage value for your desired loan term. Home loan comparison - You can compare the best housing loans for your need.

Mortgage interest is the cost you pay your lender each year to borrow their money expressed as a percentage rate. You are looking to change from your current rate to a new mortgage and borrow more on top of what you owe on your current mortgage. In addition to the standard mortgage calculator this page lets you access more than 100 other financial calculators covering a broad variety of situations.

The calculator also helps you determine the effects of different interest rates and levels of personal income on how much mortgage you can afford. Borrow from 8 to 30 years. Provides graphed results along with monthly and yearly amortisation tables showing the capital and interest amounts paid each year.

Balloon Loan Calculator. With the new GDS limit for CMHC-insured mortgages becoming 35 and the new TDS limit. Include loan-to-value ratio LTV and the current value of your property.

Browse through a vast selection of bank loan packages using our mortgage tool. But with so many possible deals out there it can be hard to work out which would cost you the least. This mortgage calculator makes it easy to see how changes in the mortgage rate or the loan amount affect the income required for a loan.

How much could you borrow. The loan is secured on the borrowers property through a process. Mortgage Calculator excel spreadsheet is an advanced mortgage calculator with PMI taxes and insurance monthly and bi-weekly payments and multiple extra payments options to calculate your mortgage payments.

Loan Payment Holiday Calculator Calculate how a payment holiday from your loan affects you. Note that you can use the sliders to adjust this amount if you want to see results for a range of figures. Under Canadian mortgage rules home buyers with a down payment of less than 20 are subject to mortgage default insurance.

How much you can afford to spend on a home in Canada is primarily determined by how much you can borrow from a mortgage provider. Find out how much you can afford to borrow with NerdWallets mortgage calculator. Skip to main content.

The Money Advice Service reckons borrowing 175000 at 3 interest over 35 years costs 34000 more than borrowing it over 25 years. This looks at how much you make in proportion to how much the mortgage will cost you each month including extras like private mortgage insurance homeowners insurance and property taxes. Use our comprehensive online mortgage calculator which shows the monthly interest only and repayment amounts on a mortgage.

Use Ratehubcas Mortgage Affordability Calculator to help figure out the maximum purchase price that you can qualify for. Decide how much you can put down as a down payment. Our affordability calculator will suggest a DTI of 36 by default.

Evaluate your total housing payments eg. Contact New American Funding today to see how much you can save. For today Thursday September 15 2022 the current average rate for a 30-year fixed mortgage is 619 increasing 11 basis points compared to this time.

Your DTI is one way lenders measure your ability to manage monthly payments and repay the money you plan to borrow. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. Cash out debt consolidation options available.

To estimate how much you can borrow use our mortgage affordability calculator. Find out how much you can borrow with our mortgage calculator that scans over 20000 mortgages from 90 lenders to find real products you could be eligible for. Pay off higher interest rate credit cards pay for college tuition.

For 202223 the triple lock rule was suspended due to the pandemic and the state pension is set only to increase by 3 inflation. Consult your insurance carrier for the exact cost. The mortgage qualifier calculator steps you through the process of finding out how much you can borrow.

Home Loan Refinancing Calculator This is a simple housing loan calculator that estimates how much you can save on your monthly housing loan instalments if you refinance your property. Loan Overpayment Calculator Use our Loan Overpayment Calculator to see how overpaying your loan payment can reduce the total cost of your loan. Fixed-Rate Mortgage Calculator.

The front-end ratio is also called the housing-expense ratio. Homeowners insurance costs roughly 35 per month for every 100000 of the homes value. Just enter your income debts and some other information to get NerdWallets recommendation for how big a mortgage.

How much can I borrow. 15 years vs 30 years. Are you remortgaging with.

You should consult with your insurance carrier but the general thought is that homeowners insurance costs roughly 35 per month for every 100000 of the home value. With a total monthly payment of 500 every month for a loan term of 20 years and an interest rate of 4 you can get a mortgage worth 72553. Loan Calculator Calculate the payments and total costs of one or more loans.

This calculator is for you if you are reviewing your financial stability as you get ready to purchase a property. You are looking to change from your current rate to a new mortgage and borrow more on top of what you owe on your current mortgage. Monthly Capital Interest.

Enter how much you wish to borrow in the Mortgage Amount box. Our mortgage calculator helps by showing what youll pay each month as. 35 years to get the full state pension of 18515 per week which itself rises each year by 25 inflation or average wage growth whichever is highest known as the triple lock rule.

Please call us to discuss. Dont forget property taxes and utilities ideally keeping them at 35 or less of your gross income. How much mortgage can I get for 500 a month.

How much you can borrow for a remortgage depends on your income and personal credit background.

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Installment Loan Payoff Calculator In 2022 Loan Calculator Mortgage Amortization Calculator Amortization Schedule

Ipmt Function In Excel Calculate Interest Payment On A Loan

I D Like To Learn The Math Behind Mortgage Interest Rates Where Should I Start Yes There Are Calculators But I D Like To To Learn How To Calculate The Interest Amounts Myself So

A Main Street Perspective On The Wall Street Mortgage Crisis

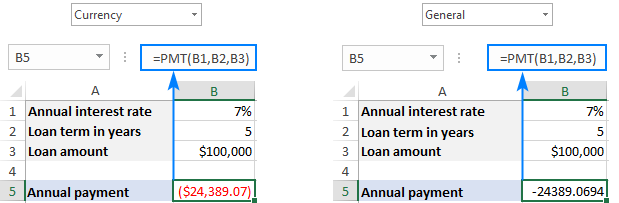

Excel Pmt Function With Formula Examples

Pin On Data Vis

Mortgage Calculators Mortgage Calculator Mortgage Refinance Mortgage

Tables To Calculate Loan Amortization Schedule Free Business Templates

How To Calculate Repayment Of A Loan In Excel Hubpages

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

How To Calculate Repayment Of A Loan In Excel Hubpages

Excel Ppmt Function With Formula Examples

Excel Pmt Function With Formula Examples

Tables To Calculate Loan Amortization Schedule Free Business Templates

Best Personal Loans In Cleveland Oh Top Lenders Of 2022 Moneygeek Com

Loan Constant Tables Double Entry Bookkeeping Mortgage Loans Loan Mortgage Calculator